- Home

- About Cancer

- Coping with a diagnosis

- Cancer and your finances

- Finding other income

- Superannuation

Superannuation

Many people have concerns about superannuation.

Learn more about:

- When can you access your super?

- How to access super early

- Do you have insurance through your super?

- Super, insurance and terminal illness

- Video: Insurance and superannuation

When can you access your super?

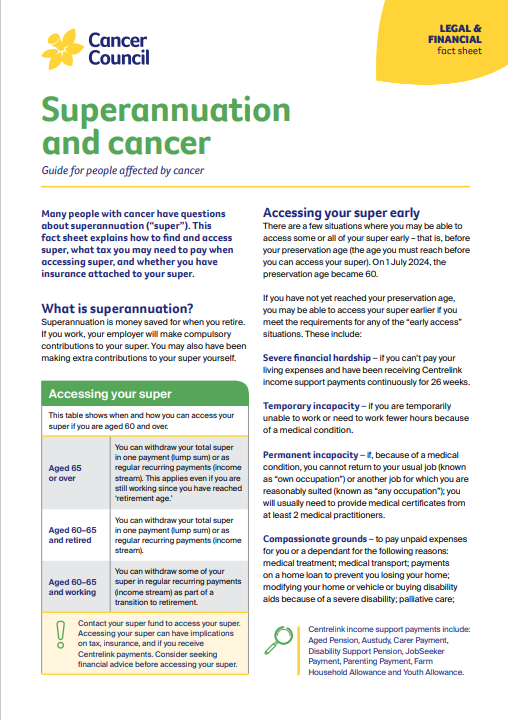

In Australia, you can access your superannuation (super) after reaching the age of 60 years old. You will usually need to be retired if under 65. You can, however, access your super early in particular circumstances, such as to pay for medical treatment or due to severe financial hardship. These are the conditions for accessing your super.

| Aged 65 or over, working or retired | Once you have reached the minimum age set by law (your preservation age), you can access your super as a lump sum or an income stream. |

| Aged 60–64 and retired | The same conditions as above apply. |

| Aged 60–64 and still working | You can access some of your super to top up your salary if you are working reduced hours. Called transition to retirement (TTR), this scheme provides an income stream from your superannuation savings. There are conditions applied to TTR. |

| Aged under 60 |

You can access your super early only in some circumstances, including if you: |

How to access super early

To access your superannuation early, you need to apply to the Australian Taxation Office (ATO) or directly to your super fund, depending on why you are applying. There are also tax issues to consider.

If you want to know more about accessing your superannuation early, you can visit ato.gov.au and search for early access to super; contact your super fund; or talk to a financial counsellor.

If you’re not sure where all your superannuation is held, call the ATO’s lost super search line on 13 28 65 to find any lost or unclaimed superannuation.

Do you have insurance through your super?

People often don’t realise that they may have insurance attached to their super. Many industry super funds, as well as some retail funds, offer insurance by default. In many cases, you will be covered if you did not choose to opt out.

Types of insurance offered through super funds include:

- life insurance (may be called death cover) – this is paid to nominated beneficiaries when the policyholder dies. Some policies will pay the insured amount if the policyholder is diagnosed with a terminal medical condition

- total and permanent disability (TPD) insurance – this is usually paid as a lump sum. Each insurer can have a different definition of what it means to be totally and permanently disabled from illness or injury

- income protection insurance – this is paid if you’re unable to do your usual job due to sickness or injury

For more details, contact your superannunation fund.

Super, insurance and terminal illness

People accessing super early because of a terminal illness might also be able to claim on their super’s life insurance. Before you decide to access your super early, find out whether doing so would affect your insurance entitlements.

Premiums for life insurance are often deducted directly from the super’s lump sum (preserved amount). If you withdraw all your super, you will no longer be up to date with the insurance premiums, so insurance cover may be cancelled. You may be able to leave some of your super in the fund so insurance premiums continue to be paid. Insurance can also be cancelled if super funds are inactive for more than 16 months.

You will need to check the qualifying time frame – superannuation law allows people to withdraw all their super if their life expectancy is 2 years or less, but many life insurance policies allow payouts only when life expectancy is one year or less. To find out more about your super, talk to your super fund or a financial adviser.

Download our fact sheets on Superannuation and Insurance.

→ READ MORE: Workers compensation

I was embarrassed talking about my financial position. The washing machine broke down and I had to use some of my superannuation funds to pay for it. I still feel embarrassed to ask for help.

Sandra

Video: Insurance and superannuation

Podcast: Coping with a Cancer Diagnosis

Listen to more of our podcast for people affected by cancer

More resources

HWL Ebsworth Lawyers, Sydney, NSW; Leigh Aitken, Consumer; Mary Bairstow, Senior Social Worker, Cancer Centre, Fiona Stanley Hospital, WA; Lynette Brailey, Team Leader Financial Counselling, Cancer Council NSW; Corinne Jones and Siew Tan, Financial Counsellors, Cancer Council VIC; Penny Jacomos, Social Worker, Asbestos Diseases Society of South Australia, SA; Dr Deme Karikios, Head of Department – Medical Oncology, Nepean Cancer and Wellness Centre, Nepean Hospital, NSW; Valerie Parsons, 13 11 20 Consultant, Cancer Council SA; Viridian Financial Group, Melbourne, VIC.

View the Cancer Council NSW editorial policy.

View all publications or call 13 11 20 for free printed copies.